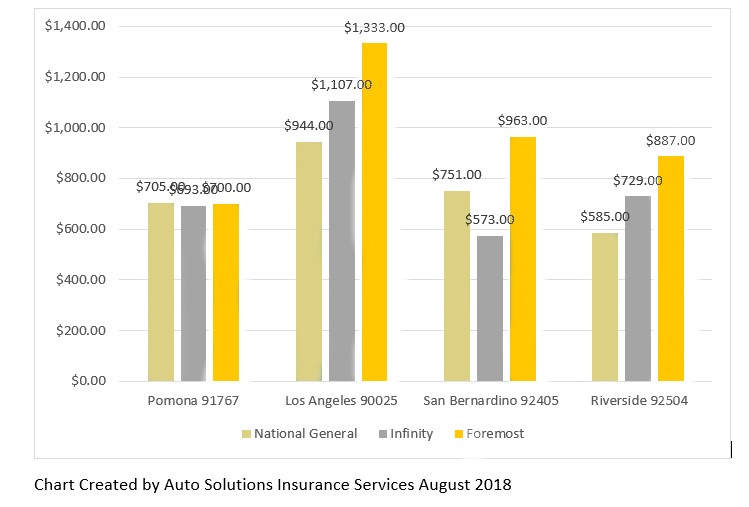

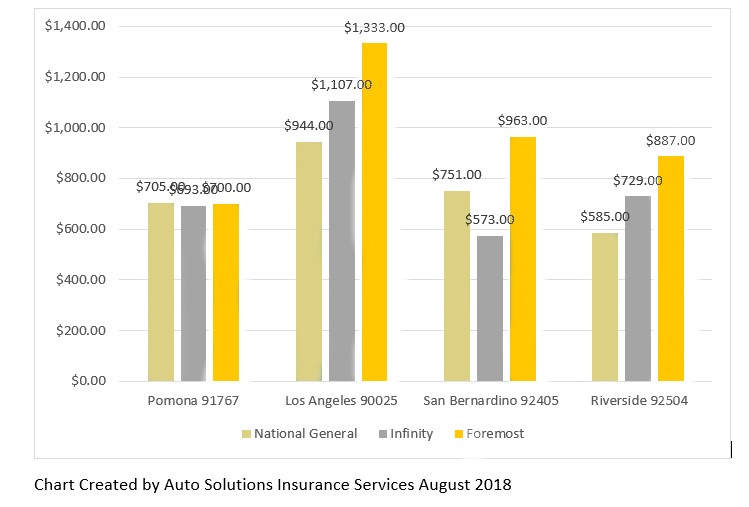

- 30yr Year Old Male – Clean Driving Record

- 2010 Honda Accord

- Coverage is liability only with limits of 15000/30000/10000

- Results are yearly premiums in each major city in the inland empire.

Finding affordable auto insurance in Southern California can be a hassle. We want to help everyone understand why So Cal residents are paying higher premiums even if they have clean driving records. We have created an auto insurance rate comparison report to show the different prices in 4 major areas around the inland empire. In this report, we are going to show you the results of several different data fields that affect the premium of insurance in your area. Furthermore, we will show how to lower these premiums and help keep the cost of your auto insurance to a minimum.

Zip Code

As you can see, where you live plays a huge role in your cost of insurance. In the above chart, you can see that Los Angeles residents are paying a significantly higher premium than many other zip codes. This is due to data showing that in those cities accidents are happening at a much higher rate, as a result, premiums are inflated. Southern Califonia auto insurance rates are somewhere in the middle when it comes to the cost of insurance. We want to show you how to lower those cost. Here are some ideas of what to look for in order to get a better rate.

Mileage

Mileage is another factor that can have a high impact on an individual premium. High mileage is usually anything over the national average of 12500. You can lower the mileage listed on the policy by providing oil change receipts showing the mileage between changes. This can save a good amount on your policy if you have a high mileage listed on your policy.

Drivers

Driver’s age, experience, and driving record are huge factors in the cost of insurance. If any drivers have tickets or accidents. Those will stay and be charged on the policy for 3 years from the date of conviction or date paid. Young or new drivers are rated higher because of the lack of experience. New drivers will not qualify for a Good Driver Discount until the 3rd year of driving. Although there are a few carriers that will still offer the discount. I recommend shopping around when looking for insurance for younger or new drivers.

Type of Vehicle

When selecting a vehicle another thing to consider is the type of vehicle. Sports cars and high-performance SUVs are rated higher than your standard sedan with normal specs. For obvious reasons, the stats show that sportier vehicles are involved in more accidents than those without the modifications for speed. Value of the vehicle is another factor here. Full coverage vehicles are rated based on the value of the vehicle being insured.

Coverage

Coverage selection is an important part and plays a huge part in the total premium. I recommend comparing the different options to see what is affordable and how it fits in your budget. Below we show what coverages are offered by most carriers. This will allow you to get a better idea of how insurance works and the affordability of each coverage.

California law requires anyone driving a vehicle to carry at least liability coverage. Liability covers third party only. Liability covers damages resulting from an at-fault accident. These damages include Bodily Injury and Property Damage to other. This coverage can range in price depending on the limits selected. Limits can vary from company to company. For instance, one company can offer limits of $15000 max per person bodily Injury to others and another company will offer limits up to $1000000. State requirements are currently $15000 per person bodily injury / $30000 per accident bodily injury / $5000 property damage per accident. Shop around and see what coverage will fit your budget.

Uninsured or Underinsured motorist is an affordable auto insurance coverage that is highly recommended due to the price and benefits. This protects the insured from any uninsured drivers. If an uninsured driver were to injure the insured or his/her passengers. This protection would cover for the bodily injury caused by an uninsured driver. Furthermore, if the vehicle is damaged it would cover the cost of repairs up to $3500. If the vehicle had full coverage. Most companies will waive the entire deductible and cover the complete cost of repairs. This coverage usually ranges from $5-$25 per month depending on the limits selected. Coverage is usually equal to the liability limits selected. An excellent coverage to have.

Uninsured or Underinsured motorist is an affordable auto insurance coverage that is highly recommended due to the price and benefits. This protects the insured from any uninsured drivers. If an uninsured driver were to injure the insured or his/her passengers. This protection would cover for the bodily injury caused by an uninsured driver. Furthermore, if the vehicle is damaged it would cover the cost of repairs up to $3500. If the vehicle had full coverage. Most companies will waive the entire deductible and cover the complete cost of repairs. This coverage usually ranges from $5-$25 per month depending on the limits selected. Coverage is usually equal to the liability limits selected. An excellent coverage to have.

When choosing medical payments it is good to look at what deductible you have on your health insurance. Medical Payments usually don’t cover much more than a health insurance deductible. It does come in handy to prevent any additional expenses that may result from having an accident. Coverage limits range from $1000 – $50000. Insurance carriers are currently not offering really high limits on this coverage.

Comprehensive and Collision can be purchased together or separately. It is more commonly purchased together as one complete coverage known as FULL COVERAGE INSURANCE.

When purchasing a new vehicle most lenders will require you to obtain comprehensive and collision coverage to protect the loan on the car. If you still have a loan it would be a good idea to ask your dealer to add gap insurance coverage. Gap covers the difference between ACV or Actual Cash Value of the vehicle and the balance of your loan. If there is a total loss of the vehicle, having a remaining balance that you have to pay on, would not be good. Feel free to compare full coverage auto insurance rates online now.

Rental and Towing

This is an additional Coverage that is not automatically added to most policies but is recommended. Especially if you only have one vehicle. Towing can be expensive. This helps save on more unexpected expenses. Prices usually range from $3 to $10 per month

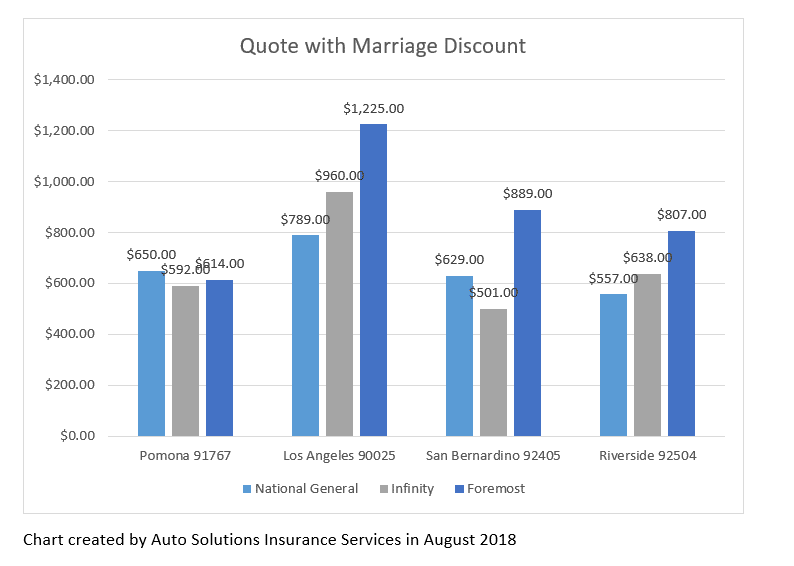

On the above quote, we showed you how simply adding a discount can save you hundreds of dollar on your auto insurance. To ensure that you are getting the best possible rate. Be sure to ask what discounts are available to you. Here is a list of discount that most companies will offer.

Discounts:

Another clear shot way to get a better deal is to compare your rates. Settling for the first available option can be a costly mistake. On average people save up to $416 per year just by comparing their options online. With today’s technology, this is a no-brainer. There are so many different ways to compare nowadays. 2autoinsurance.com has one of the most innovated methods to date. You can actually compare with up to 25 different programs and carriers with one simple form. Users usually receive a quote in less then 2 minutes. Once you see the quote you like you can simply select purchase policy button on the page and a link to purchase will be sent directly to the email provided. Simple as that! Compare online now.

Yeah maybe this sounds a little old fashion, but talking to an experienced agent can sometimes be the best thing available. The keyword here is EXPERIENCED. The benefits of talking to an agent is that they will know what questions to ask in order to ensure that you are getting everything you need in your policy. This includes recommendations on the amounts of coverage needed and making sure you are getting those money saving discounts. Also, it’s nice to be able to get all your questions answered as they pop in your head. I know that as we move more and more into technology this option becomes less and less appealing, but it’s still my personal favorite. I might be a little bias because I’m one of these dinosaurs myself.

Phone: (909) 996-1153

Address: 8137 Malachite Ave Suite G, Rancho Cucamonga, CA 91730

Phone: (909) 275-7245

Address: 16055 Foothill Blvd, Fontana CA 92335 ( Inside Superior Market )